In the film Martian Chronicles, based on one of Ray Bradbury's vignettes, monks from Earth encounter some sentient beings called The Old Ones. They appear as bright blue flaming spirits within crystal spheres. They are self-existent. Each contains, within his very being, his own inexhaustible source of life and sustenance.

In the film Martian Chronicles, based on one of Ray Bradbury's vignettes, monks from Earth encounter some sentient beings called The Old Ones. They appear as bright blue flaming spirits within crystal spheres. They are self-existent. Each contains, within his very being, his own inexhaustible source of life and sustenance.

Thus, The Old Ones have no need of air, water, food, clothing or shelter. They can survive in any environment. They have no need of any external economic input. They simply have the means and desire to communicate and relate benignly with others. Capitalism could never enslave them because it has no way of imposing a control barrier between them and their means of survival. An individual, whose means of survival is an inseparable part of himself, can never be enslaved.

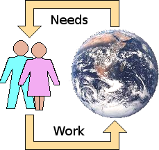

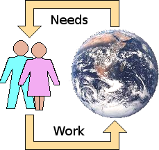

On the other hand, as a physical human being, I am profoundly aware that my body cannot survive outside the Earth's biosphere. Its life function cannot sustain itself for more than 3 minutes without air, 3 hours without warmth, 3 days without water or 3 weeks without food. All these are supplied continuously and exclusively by the mechanisms that constitute the terrestrial biosphere. My mind, even more so, vitally depends for its formation and development on what it receives via my 5 bodily senses from my terrestrial environment. Thus I am an integral sub-system of the Earth's biosphere. As a living being, I cannot be functionally separated from it.

Nature equipped me with a mobile body. This has the energy and strength to acquire its needs of life from its terrestrial environment. It is able to breath, in order to sustain its energy-liberating combustion process. It's able to seek, find and drink water when thirsty. It is able to gather and eat food when hungry. These are its natural functions as an integral part of Gaia. The human was thus constructed by nature to breath, seek, drink, gather, eat and defecate in order to sustain itself from its environment.

Nature equipped me with a mobile body. This has the energy and strength to acquire its needs of life from its terrestrial environment. It is able to breath, in order to sustain its energy-liberating combustion process. It's able to seek, find and drink water when thirsty. It is able to gather and eat food when hungry. These are its natural functions as an integral part of Gaia. The human was thus constructed by nature to breath, seek, drink, gather, eat and defecate in order to sustain itself from its environment.

Importantly, Gaia does not demand payment in return for the air, water or food that I consume. Gaia does not charge me £X per litre for the air I breath or the water I drink. Gaia does not charge me £Y per kilogram for the food I eat. Gaia does not charge me £Z per hectare per month for the planetary surface I occupy. It's all free.

I don't need to ask Gaia's permission to take from her my needs of life. I am free to take my needs of life entirely at my own individual initiative. Gaia does not forbid or forcibly bar me from taking my needs just because I have nothing I can offer her that she needs or desires. I am not deemed to be in debt to her for what I take or the space I occupy. As an inseparable part of the terrestrial biosphere, my freedom to take my needs of life from it is self-evidently my inalienable right.

Nature has equipped humans uniquely with a degree of creative intelligence lower animals do not have. This has empowered us to develop methodologies and technologies to create a production process. Through such, a family is able to acquire its needs from its terrestrial environment more efficiently and reliably. It demands less work, thus liberating more of our time for learning, creative and re-creative pursuits, and social interaction.

Nature has equipped humans uniquely with a degree of creative intelligence lower animals do not have. This has empowered us to develop methodologies and technologies to create a production process. Through such, a family is able to acquire its needs from its terrestrial environment more efficiently and reliably. It demands less work, thus liberating more of our time for learning, creative and re-creative pursuits, and social interaction.

In this way, each family unit is self-sufficient in the basic needs of life, yet has the freedom to interact with others through unfettered social relationships. This is the foundation of a natural egalitarian society of equal peers.

A Means of Exchange

Certain basic abilities are common to all human beings. These they can use to acquire their basic needs of life. Humans also, however, have a wide range of special abilities. These seem to be shared out between different individuals. People often refer to these as gifts or talents. They make some individuals apt for certain specialised tasks and other individuals apt for other specialised tasks. They make different people good at different kinds of work.

Gifts or talents thus enable different kinds of people to produce different kinds of products or render different kinds of services. Although relatively few are good at a particular kind of specialised task, a lot of others could benefit from its use. Consequently, in the case of these specialised products or services, each person should be a specialised producer but a generalised consumer.

A means is required for each person to exchange most of his own specialities for the many different specialities of others. This means is a barter market. Each family consumes as much of its own specialised produce as it needs. It then takes the remainder to the barter market. There it exchanges its surplus for the different specialities of other producers.

The basic needs of life are mainly the products of agrarian production processes. Productivity, at any given time, thus depends on the weather. Harvests can vary from year to year from region to region. Those with a surplus in a particular place at a particular time can therefore distribute it via the market to those who, at that same time in a different place, lack a full measure of their basic needs.

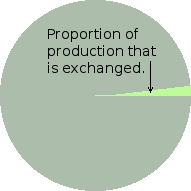

By exchanging only surpluses, the amount of goods exchanged is only a small fraction of those produced and consumed. This situation is what, in economists' parlance, is confusingly referred to as a small economy, even though production and consumption can be large. It reminds me of ridiculous statements banded around in the 1980s such as that the economy of the entire Soviet Union was no bigger than that of Holland.

The Notion of Credit

When a family production unit has a surplus, it takes that surplus to the market to exchange for a wide range of other goods for which it has need or desire. However, at the time it takes the surplus to market, the goods it needs or desires in exchange may not be available. Perhaps they become available at a different time or in a different season. However, another family may have need of this family's surplus now.

The solution is a credit control system. For this to function, there must exist a universally accepted quantum of value that can be attributed to whatever surplus good or service a family sells via the market. I shall call this universal quantum of value the Val. The size of the Val should be set at the universally perceived value of the smallest quantity of the least valuable good or service that can be exchanged via the market.

Thus, when the family takes its surplus of basic needs or specialised products to the market, it can exchange them for a note stating the appropriate number of Vals. The note may be written on paper, which the family then keeps until the particular goods or services it needs or desires become available. Alternatively, the number of Vals could be stored as a numeric quantity in a credit account kept in a computer file.

The great flaw or weakness in a universal system of credit is that any human being will generally perceive his own specialised skills, goods or services to be more valuable than those of other people. Thus the allocation of a universal value to a particular good, service or skill is highly subjective. It will thus precipitate an inevitable battle over what are and are not acceptable values for things.

The most stable and fair form of economy is therefore to keep exchange to the minimum possible, while allowing all to benefit from the specialised abilities of each. Such an economy is self-evidently best suited to support an egalitarian society of equals, which to my mind is the ideal. And it is all achieved without the need for capital. How?

A human being's labour can be converted into his needs of life only by applying that labour to appropriate terrestrial resources. Without terrestrial resources to convert it, human labour can produce nothing. In the economic system outlined above, each human freely applies his labour to the Earth and freely takes what the Earth yields sustainably in response to that labour. He thus lives in benign symbiosis both with the Earth and with his neighbours.

From Symbiosis to Exploitation

If I diligently apply my labour to my fair and rightful share of Gaia's garden, she will yield to me bounteously my needs of life. But sadly, it is a rare individual who is content merely to do this. Most would like to live idly off the fruits of the labours of others. A few succeed. Most never get any further than merely chasing the dream of so doing. Thus, there are essentially 3 kinds of person:

He who, by conscience, feels obliged and content to live adequately upon the fruits of his own labour.

He who has no qualms about using his combative or manipulative skills to enable him to live richly upon the fruits of the labour of others.

He who dreams of being able to live richly upon the fruits of the labour of others but never encounters the necessary good fortune.

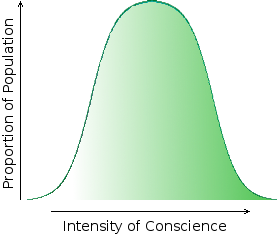

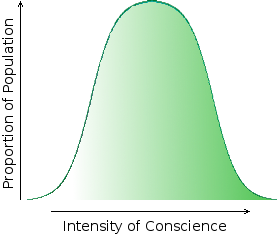

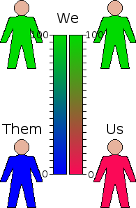

The first kind of person is driven by his inherent natural conscience. The second kind of person has no conscience and is therefore driven by his inherent natural greed. The third kind of person is driven by an external social conscience, which is formed under the influence of people of the second kind.

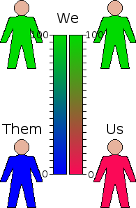

In reality, the boundaries between these three kinds of person, within a population, are not abrupt. The variation in intensity of a person's conscience varies continuously throughout a population as illustrated on the left. There is some research to indicate that persons of the second kind comprise about 1% of a population. They are the small minority represented by the white area at the extreme left of the adjacent graph. I think it is reasonable to speculate that there be a corresponding minority on the right of the graph (green) comprising persons of the first kind.

In reality, the boundaries between these three kinds of person, within a population, are not abrupt. The variation in intensity of a person's conscience varies continuously throughout a population as illustrated on the left. There is some research to indicate that persons of the second kind comprise about 1% of a population. They are the small minority represented by the white area at the extreme left of the adjacent graph. I think it is reasonable to speculate that there be a corresponding minority on the right of the graph (green) comprising persons of the first kind.

Suppose I am a member of the minority that comprises persons of the second kind. How do I realise my ambition to live richly off the labours of others?

I devise some kind of mechanism that redirects the fruits of the labours of many into my hands. I cannot, however, take all of the needs of life that these people produce by their labours. I must pass on to them at least the minimum necessary and sufficient needs of life for them to be able to sustain themselves. Otherwise, they will not be able to continue to live, work and produce for me. I may even face wholesale insurrection and lose all, including my own life.

I devise some kind of mechanism that redirects the fruits of the labours of many into my hands. I cannot, however, take all of the needs of life that these people produce by their labours. I must pass on to them at least the minimum necessary and sufficient needs of life for them to be able to sustain themselves. Otherwise, they will not be able to continue to live, work and produce for me. I may even face wholesale insurrection and lose all, including my own life.

But what possible motive could members of this vast middle majority have for donating the major proportion of the fruits of their labours to me? Perhaps if I were mentally or physically incapacitated in some way they would donate a small proportion of the fruits of their labours to me out of kindness or by obligation of conscience. But there is no such moral reason for them to sustain me, especially in a life-style that is far above their own. Consequently, the only options open to me for making them donate the greater parts of the fruits of their labours to me are coercion and deception.

Forcibly Excluded

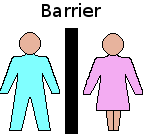

I therefore forcibly separate Man from Gaia. I create an impenetrable barrier, which I control, between mankind and his natural environment. This barrier enables me to control where, when and how members of this vast majority may apply their work to the Earth. It also enables me to control how much of the fruits of their labour pass outwards through it to those whose work produced them.

I therefore forcibly separate Man from Gaia. I create an impenetrable barrier, which I control, between mankind and his natural environment. This barrier enables me to control where, when and how members of this vast majority may apply their work to the Earth. It also enables me to control how much of the fruits of their labour pass outwards through it to those whose work produced them.

This barrier is essentially force of arms. How it is applied depends on where I am in the history of mankind. Anciently, perhaps I was the ringleader of a band of thugs who pillaged the barns of hapless peasants once their harvest was gathered in. In middle times, I am a local baron who, under the threat of my hired arms, demands the lion's share of everybody's harvest. Later, I am a king or an emperor demanding of my subjects tribute-in-kind in return for not sending my army to annihilate them.

Later still, I am the lord who, having been granted the right by royal or parliamentary decree, enclose all common land, claiming ownership of it as my private possession. I, in turn, take some of the hapless majority as my slaves (or serfs) to toil on my land to provide my needs in return for their minimal food, clothing and shelter.

However, I do not need to utilise all the land I have enclosed and claimed in order to support a generous lifestyle for myself and to sustain my slaves. In fact, I only need use a small proportion of it. The rest I leave as wilderness in which I may entertain myself and guests by hunting wild animals. There remains, nevertheless, the problem of all those hapless masses whom I have expelled and who have no place to go. If I am not careful, despite all the support I may have from the King's army, these masses will become so desperate that they will rise up, invade my land and probably end up wiping me out. How can I appease them without losing what I have taken?

My solution is to let a portion of my land. I let each family use a minimal allotment of my land in return for the payment to me of an annual rent. This rent may be in kind or, if they can exchange what they produce for credit in the Trading Market, they can pay the rent to me in money. But I will only let my land to those who can convince me that they will be responsible, productive and honest. The remainder I exclude from all my land, including the wilderness that stays unused.

My solution is to let a portion of my land. I let each family use a minimal allotment of my land in return for the payment to me of an annual rent. This rent may be in kind or, if they can exchange what they produce for credit in the Trading Market, they can pay the rent to me in money. But I will only let my land to those who can convince me that they will be responsible, productive and honest. The remainder I exclude from all my land, including the wilderness that stays unused.

The Artisan Tenant

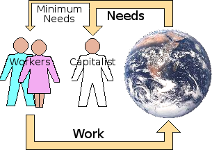

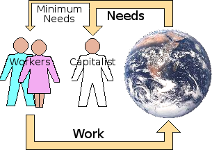

The successful families use the land and the space it provides to grow food, keep animals and practise various forms of artisanry. But they are now not using the Earth as a self-evident right of living beings born upon it. They are using it exclusively and expressly by my leave. Systemically, they now have access to Gaia only via me. They now sell their excess produce and buy the needs they lack exclusively via the market.

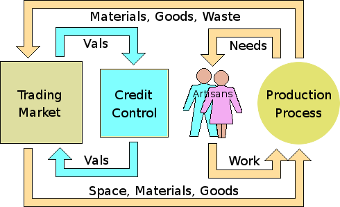

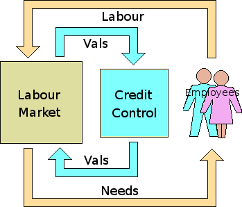

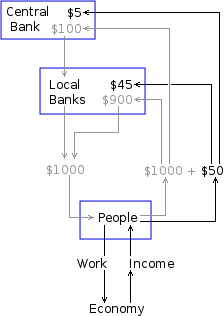

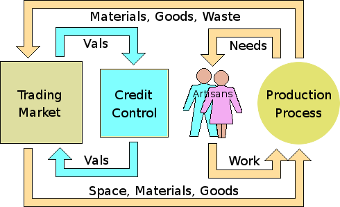

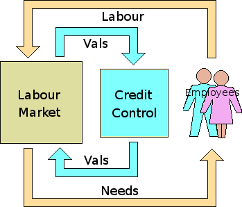

Their basic economic operation is as shown on the left. They rent a small area of land from me. I am thus part of their supply market. They also buy from the market raw materials and finished goods. They use these for agricultural processing of seed into foodstuffs and for industrial processing of raw materials into finished goods, both for their own consumption and for sale via the market.

Their basic economic operation is as shown on the left. They rent a small area of land from me. I am thus part of their supply market. They also buy from the market raw materials and finished goods. They use these for agricultural processing of seed into foodstuffs and for industrial processing of raw materials into finished goods, both for their own consumption and for sale via the market.

Their Production Process also includes the domestic processing of agricultural produce and purchased goods into ready meals and material items for supporting their lifestyle. They keep track of any imbalance between inputs and outputs from and to the market via a credit control circuit the same as they did before I dispossessed them of their free and unencumbered access to Gaia.

But how does the tenant artisan buy his initial seed and equipment — plough, oxen and so on? He has his final harvest from the Gaia-based economy that he had before I forcibly expelled him from the land he was using when I claimed and enclosed it for myself in accordance with royal or parliamentary decree. This, however, was economically scaled merely to sustain him, provide his seed and maintain his equipment for the coming year. Just the way it always used to be.

Unfortunately, he now has an untimely additional cost, which is not small. It is the annual land-rent he must pay to me in order to be able to occupy and use the land he previously used for free. But he has no means of paying me the first year's rent. He needs starting capital. He must also become more productive in order to sustain this additional cost in future years and to pay back his starting capital to whomsoever may condescend to lend it to him.

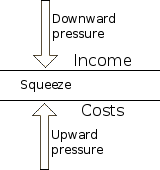

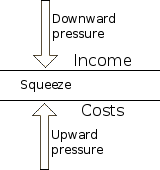

The artisans depend on the market to acquire money in exchange for their produce. And it is the possessors of the Earth, the nobility, who hold the strings of the market. Artisans need to sell to survive. The nobility doesn't need to buy to survive. This pressures the artisan's income down. The Nobility don't need to sell to survive. The artisans need to buy to survive. And they need to pay their rents. This drives the artisan's costs up. The artisan's rate of income is thereby squeezed between two ever-tightening limits.

The artisans depend on the market to acquire money in exchange for their produce. And it is the possessors of the Earth, the nobility, who hold the strings of the market. Artisans need to sell to survive. The nobility doesn't need to buy to survive. This pressures the artisan's income down. The Nobility don't need to sell to survive. The artisans need to buy to survive. And they need to pay their rents. This drives the artisan's costs up. The artisan's rate of income is thereby squeezed between two ever-tightening limits.

The artisan is thus forced to buy from a seller's market and sell to a buyer's market. His income is squeezed by market forces until he has only just enough to survive. The money gained from his ultimate harvest runs out. He does not even have the wherewithal to buy his essential inputs for the coming season. He certainly doesn't have enough to be able to save. He will therefore never be able to capitalise a new season from his previous season's harvest. His only option is to borrow starting capital from somewhere. But where?

What of the majority who are unable to convince me that they are productive, honest and responsible. I exclude them from all my land, including the wilderness that remains unused. I expel them to the highways and by-ways to wander with no place to settle, dispossessed of the planetary eco-system, which is an inseparable element of their very life-process. Their only option for survival is to become itinerant jobbers and robbers, relegated to a precarious existence on the wrong side of the law.

What of the majority who are unable to convince me that they are productive, honest and responsible. I exclude them from all my land, including the wilderness that remains unused. I expel them to the highways and by-ways to wander with no place to settle, dispossessed of the planetary eco-system, which is an inseparable element of their very life-process. Their only option for survival is to become itinerant jobbers and robbers, relegated to a precarious existence on the wrong side of the law.

Justifiably, many of these hapless wanderers organise themselves into marauding bands and even armies of professional plunderers. Their sheer numbers may even elevate them to the power of conquerors that will eventually dispossess even me and my kind of our allodial estates. The King may hire many as soldiers to enable him to realise his foreign ambitions. But there is only a call for some. Most must remain in the wretched state of wandering dispossession. But how do I avoid the inevitable mass insurrection? My artisan tenants provide the solution.

The Birth of Slavery

Some of my artisan tenants work diligently with the resources that are available to them. They amass substantial assets and credit. They gain incisive knowledge as to how their tiny economic units fit and function within the market environment. They develop the skills necessary for keeping them optimised between efficiency and resilience. They are now able to direct others to do the labouring while they simply manage.

One person can instruct and direct many. Consequently, the artisan tenant is able to responsibly rent more land from me and take on employees in order to expand his economic endeavour. He has thus progressed from being an artisan who works for himself to being an entrepreneur for whom others work. He has created a demand for labour. But from whence do his workers come? And what possible motive could they have to work for him?

I have no reason to want to work for him. I possess my lands and command the labour of my slaves. His equals have no motive to work for him. They have their own enterprises to manage. But the multitude of dispossessed jobbers and robbers that wander the highways and by-ways, are desperate for a more dependable means of sustaining their lives. As many as are able therefore become the willing slaves of the tenant artisan-turned-entrepreneur. They will gladly provide their labour in exchange for their minimal-but-certain needs of life.

I have no reason to want to work for him. I possess my lands and command the labour of my slaves. His equals have no motive to work for him. They have their own enterprises to manage. But the multitude of dispossessed jobbers and robbers that wander the highways and by-ways, are desperate for a more dependable means of sustaining their lives. As many as are able therefore become the willing slaves of the tenant artisan-turned-entrepreneur. They will gladly provide their labour in exchange for their minimal-but-certain needs of life.

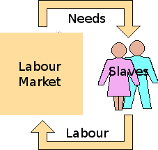

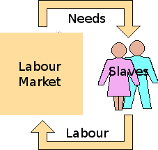

My slaves are bound. They are not allowed to leave me to seek better circumstances with another lord. However, the slaves of the entrepreneur are not bound to him.

The unbound slave is free to leave one master to work for a different one if he so wishes. As technology — and hence specialization — increases, it is much more flexible to have the unbound slave population form a free-market source of labour. This enables any master to hire labour of any particular skill as and when he needs it. Nevertheless, the lot of the slave is still the same. He must work for one master or another. His freedom to change his master does not free him from his state of slavery.

The unbound slave is free to leave one master to work for a different one if he so wishes. As technology — and hence specialization — increases, it is much more flexible to have the unbound slave population form a free-market source of labour. This enables any master to hire labour of any particular skill as and when he needs it. Nevertheless, the lot of the slave is still the same. He must work for one master or another. His freedom to change his master does not free him from his state of slavery.

So, from the point of view of the so-called unbound slave, the labour market is the master to whom he is bound. He is not bound to the labour market by force of law like my slaves are to me. He is bound to it by a much stronger and more austere force. It is the force of biological survival. If he is not a slave to the labour market he cannot eat. He cannot clothe himself. He has no shelter or place to sleep. Whichever way you choose to view it, he is still just as much a bound slave. He has to serve somebody.

Unlike me, an entrepreneur hires and fires his slaves according to seasonal fluctuations in his need for their labour. Providing seasonal slaves with their multiple and various needs of life for short periods is an administrative nightmare. It is far more convenient for the entrepreneur to furnish them with an amount of credit with which to buy their needs of life at the market. His slaves thus become his employees. But this is merely a change in their method of remuneration. The fundamental nature of the relationship between the entrepreneur and his workers is still the same. They are still slaves.

Unlike me, an entrepreneur hires and fires his slaves according to seasonal fluctuations in his need for their labour. Providing seasonal slaves with their multiple and various needs of life for short periods is an administrative nightmare. It is far more convenient for the entrepreneur to furnish them with an amount of credit with which to buy their needs of life at the market. His slaves thus become his employees. But this is merely a change in their method of remuneration. The fundamental nature of the relationship between the entrepreneur and his workers is still the same. They are still slaves.

Instead of paying wages in kind, the entrepreneur pays wages in cash with which the slave buys kind at the market. This is just a more indirect way of achieving the same thing. Systemically, it is the same. Slavery has never been abolished. It has merely been masked. A slave is anyone who does not have direct and unencumbered use of sufficient terrestrial resources to turn his own labour into his needs of life. By this definition, the overwhelming majority of people in the world today are slaves. They are the bond slaves of the capitalist free market.

The more valued employees of modern corporations are increasingly being offered packages that include a substantial element of payment in kind. Instead of being offered simply a high salary, these employees are offered a lower monetary salary plus a host of options that are provided in kind. These include life insurance, medical plan, credit card, subsidised travel, discounted company produce, a company car and even a company house. Such things tend to bind an employee economically to his employer. This is, in essence, a hybrid of employment and bond-slavery. The employee is not bonded by force of law. Nevertheless, he finds himself under substantial economic pressure not to leave.

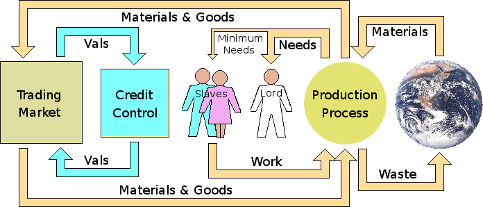

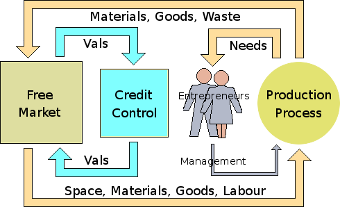

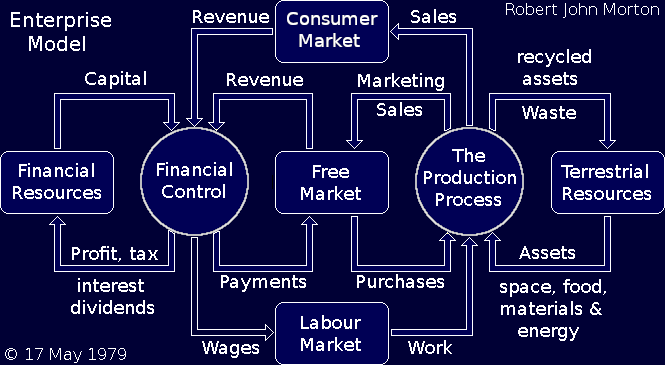

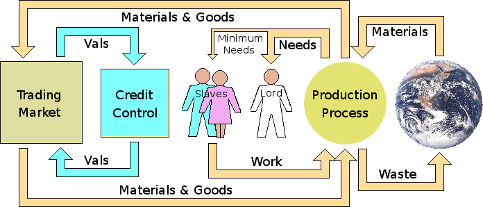

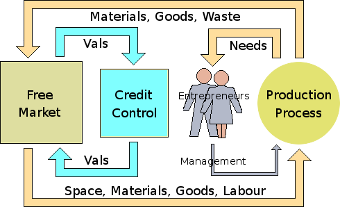

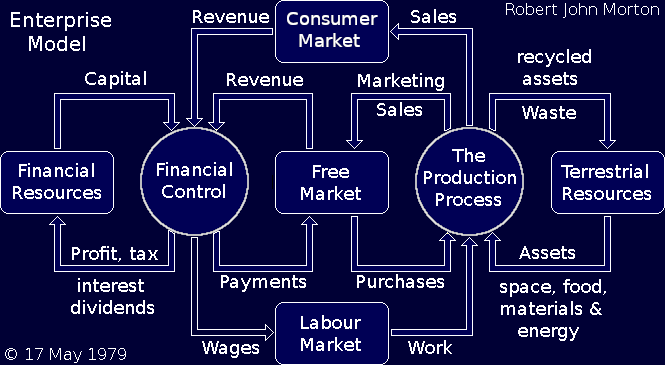

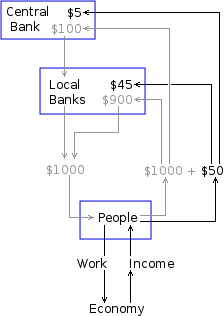

The idyll of antiquity, where the individual directly grazed the bounties of nature to sustain his life, has thus been replaced by a far more complex and insidious economic device called the modern enterprise, the generic flow model of which is shown below.

The needs of life can only be produced by applying human labour to terrestrial resources. There is no other way. Consequently, the modern enterprise, however indirectly, must do exactly this. Notwithstanding, the proprietor of a modern enterprise does not own any terrestrial resources. I, the local lord, own the land. The entrepreneur is thus forced to rent his necessary terrestrial resources from me, be it to grow a crop, provide materials or simply for factory or office space.

The upshot is that to kick-start his enterprise, the entrepreneur needs starting capital, with which to rent the necessary terrestrial resources and to meet his initial equipment and labour costs. The whole business process is therefore inexorably bound to start with an enormous loan to initially charge up its money battery. This must come from a source that I shall generically call the banker

The starting capital thus comes under the entrepreneur's control. He spends some of it in the real estate market — which is part of the free market — to rent land and accommodation for his enterprise and also in the free market to buy equipment and materials for his production process. He spends some also to hire workers from the labour market.

If the enterprise is involved in agriculture or mining, the entrepreneur may take directly from nature what nature provides from the land that he rents. Most enterprises, however, don't have direct access to the natural environment for input resources other than accommodation space. Generally, therefore, an enterprise acquires all the material inputs for its production process by buying them from the free market.

The enterprise then starts to produce or render its products or services and sells them into the free market in return for money. It then uses the money it thus gains to repay the capital it borrowed and also to pay the interest that has accrued on the capital. It must also pay any taxes levied by the jurisdiction (such as a State or kingdom) in whose territory it operates.

Operating within the free market is risky. To transfer these risks to his economic inferiors, the entrepreneur incorporates his enterprise as a limited liability entity — a pessoa jurídica. With this, the option of being a good master or a bad master to his "slaves" ceases. By incorporating, the entrepreneur becomes bound by a legal obligation to be a bad master. He is required by law to - by all best endeavour - put the maximisation of profit above all else. This binds him by legal obligation to — by all best endeavour — maximize revenue and minimise all costs — including labour costs. This means maintaining a tight squeeze on wages, keeping them as close to basic survival level as possible.

His obligation to minimise costs also forces the entrepreneur to externalise as many problems as possible. Consequently, he is unconcerned with the effects of dumping waste up on either the environment or the people who live in it.

The Lord's New Role

I find running my allodial estate complicated and burdensome. I have to organise and manage the planting, care and harvesting of crops, the rearing and care of animals, the scheduling of hunts and cullings, the seasoning and felling of trees. With all this, I must organise, manage and supply the needs of my slaves.

Besides all this, I am beginning to feel increasingly vulnerable to external threats. A more socially-aware population is pressuring me to grant employee status to my slaves. My vastly disproportionate wealth is becoming ever more visible to their envious eyes.

I need to find a way to reduce my administrative burden and protect myself and my wealth from the potential ravages of social change. I want to be less tied to my estate and gain the freedom to live and to travel where I will. I therefore adopt the following strategy.

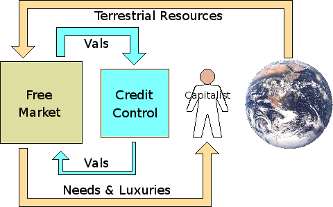

While retaining ownership of it, I rent out the use of my land, via the free market, to whomsoever is able to put it to profitable use. They thereby become responsible for managing and working it. Some may use it for agriculture. Others may mine minerals from it, for which they must also pay me a royalty on the sale of whatever they mine. Others may use it simply as space in which to erect factories, offices or residences.

While retaining ownership of it, I rent out the use of my land, via the free market, to whomsoever is able to put it to profitable use. They thereby become responsible for managing and working it. Some may use it for agriculture. Others may mine minerals from it, for which they must also pay me a royalty on the sale of whatever they mine. Others may use it simply as space in which to erect factories, offices or residences.

All I do is hire somebody to administer the receipt of rents and royalties, some of which I may receive in kind but most as money. My wealth is thus generated for me by the labour of the employees of the entrepreneurs who rent and use my land. And this is simply because I happen to be one of the favoured few who is deemed, by a divisive system of law, to own a part of my planet.

This is a much easier and more lucrative way of life for me. I use a minuscule part of my income to buy my needs of life from the free market. The rest I accumulate as capital. I am now free to live where I wish and to travel when I wish. I have a sumptuous apartment in the city and a country residence in a private corner of my estate. Of course, I still keep a small patch of my land to have employees run for me as a farm or other enterprise. My ownership of my land is protected by force of law, which is the force by which I originally stole it from the rest of my countrymen. Since my ownership is protected then so too is my generous income.

For me, life is easy and predictable. However, from within the workshops of petty artisanry, a cancerous revolution is growing abnormally and rapidly. This will soon envelop the world of industry and commerce and power it along its path to ultimate self-destruction.

The Gold Standard

The conceptual means of exchange that I have use so far in this article is the Val. The Val is consequently a form of money. However, unlike modern currencies, it cannot be lent out in return for interest. It is purely and simply a means of exchange. Examples of counterparts of my concept of the Val in the real world are the Colonial Scrip in the fledgling United States of America and the Bobbin used in the United Kingdom during the Thatcher era — and to some extent thereafter. These were — and are — ideal means of exchange. The problem with them is that they render the banking system irrelevant. Nobody can grow rich by exploitation and usury, which, within our modern societies, is deemed to be unacceptable.

Another — interest-bearing — means of exchange had to be found and imposed upon the entirety of the trading world. And that means of exchange started off in the form of gold. Since the dawn of history, human beings have been fascinated by gold. This is probably, in part, because of its shiny appearance and colour. But most strongly because of its "nobility" — its resistance to contamination and corrosion. In other words, its permanence. Additionally, gold occurs rarely within the mantle of this planet. All these factors make gold desirable. People want to possess it for its beauty, nobility and rarity.

Another — interest-bearing — means of exchange had to be found and imposed upon the entirety of the trading world. And that means of exchange started off in the form of gold. Since the dawn of history, human beings have been fascinated by gold. This is probably, in part, because of its shiny appearance and colour. But most strongly because of its "nobility" — its resistance to contamination and corrosion. In other words, its permanence. Additionally, gold occurs rarely within the mantle of this planet. All these factors make gold desirable. People want to possess it for its beauty, nobility and rarity.

For this reason, people attribute to it an intrinsic value, even though it has no practical value whatsoever for the purpose of sustaining human life. After all, one cannot eat it, drink it, wear it as clothing, shelter under it or ride it from one place to another. All it can be used for is to form or coat objects of art to make them more beautiful to look at. [Gold's modern industrial value as a metal for coating electrical signal connectors is nothing compared with the intrinsic value that it universally enjoys as a result of its beauty, nobility and rarity.]

Gold's universally-perceived intrinsic value, together with its permanence, make it an ideal means of exchange. An artisan can sell the table and chairs that he has made for what is perceived to be an amount of gold of equivalent value. Unlike an IOU written on paper, its value does not rely on the credibility of the payer. Its value is universally accepted. The artisan can later spend his gold in payment for those needs of life that he cannot produce himself. Gold, as a means of exchange, enables a person to trade beyond his local community with people he does not know personally or by reputation.

The Ancient Goldsmith

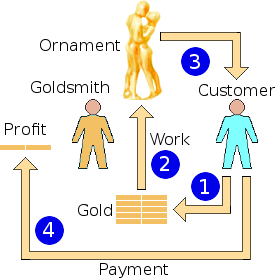

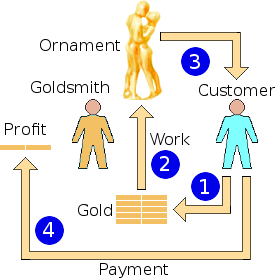

Around 1000 AD, goldsmiths — those who used gold as the basic raw material of their artisanry — found that its universally-perceived value, as a beautiful noble rare metal, provided them with an opportunity, which was simply not open to the artisans of other materials like wood and iron. Nor, for that matter, was this opportunity open to anybody else, whatever their trade or profession.

Suppose I am one such ancient goldsmith. A customer supplies to me 10 bars of gold with which to make an ornament for him. It remains his gold. It is not mine. With my artisanic skills, I form my customer's gold into the ornament he desires. I deliver the ornament to him. For my work, he pays me 2 bars of gold. I spend 1 bar to obtain my needs of life. I store the other bar in my vault. I repeat this cycle until I have 100 bars of gold. Thieves and robbers would go to great lengths to take my gold. So, as a goldsmith, one of the vital necessities for my place of work is a very strong and secure vault in which to keep my stock of gold.

Suppose I am one such ancient goldsmith. A customer supplies to me 10 bars of gold with which to make an ornament for him. It remains his gold. It is not mine. With my artisanic skills, I form my customer's gold into the ornament he desires. I deliver the ornament to him. For my work, he pays me 2 bars of gold. I spend 1 bar to obtain my needs of life. I store the other bar in my vault. I repeat this cycle until I have 100 bars of gold. Thieves and robbers would go to great lengths to take my gold. So, as a goldsmith, one of the vital necessities for my place of work is a very strong and secure vault in which to keep my stock of gold.

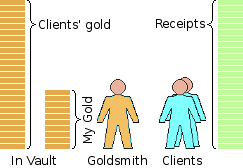

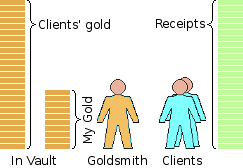

Such a vault is far from cheap. It is not therefore something that other people would generally have in their homes or workplaces. Consequently, other people ask me if they can store their gold bars in my vault. This I gladly do in return for a small fee, which I regard as a fair rent for the space their gold bars will occupy inside my vault.

Paper Receipts for Stored Gold

When I accept the business of storing a gold bar that belongs to somebody else in my vault, I must issue to that person a receipt acknowledging that the bar of gold concerned belongs to him and not to me. For each bar of somebody else's gold that I store in my vault, I therefore issue a receipt or IOU ("I owe you") note, something like that shown on the left. This states that I will devolve one bar of gold back to him in exchange for the note.

When I accept the business of storing a gold bar that belongs to somebody else in my vault, I must issue to that person a receipt acknowledging that the bar of gold concerned belongs to him and not to me. For each bar of somebody else's gold that I store in my vault, I therefore issue a receipt or IOU ("I owe you") note, something like that shown on the left. This states that I will devolve one bar of gold back to him in exchange for the note.

Consequently, for each gold bar in my vault that belongs to a client, there exists 1 receipt bearing the name of the client to whom it belongs. The gold bars are in my vault. All their corresponding IOU notes are "out in the field" in the possession of my clients. I do not have receipts corresponding to the gold bars in my vault that are my own. If any client comes to me and gives me an IOU note, I give him back one bar of gold.

Consequently, for each gold bar in my vault that belongs to a client, there exists 1 receipt bearing the name of the client to whom it belongs. The gold bars are in my vault. All their corresponding IOU notes are "out in the field" in the possession of my clients. I do not have receipts corresponding to the gold bars in my vault that are my own. If any client comes to me and gives me an IOU note, I give him back one bar of gold.

So, in addition to my trade of making ornaments using gold, I now earn a little bit more in the form of fees for storing safely gold bars belonging to others. [Those "others" are, at least initially, the noble lord and his extended family. They are the only people likely to possess gold. The ex-smallholders who became the artisan farmers would not inherit or possess gold. Neither would they have any other means of acquiring it.]

This presents me with a third, far more lucrative, business opportunity. Remember that all except the nobility have long since been dispossessed of terrestrial resources. Land, shelter, food and clothes must all be bought in exchange for other material items or for money via the market.

Remember that, after the lord confiscated his land by enclosure, the artisan-farmer needed starting capital with which to pay his first year's land-rent. He must also become more productive so that he can meet the additional cost of land-rent in subsequent years and also pay back his borrowed first-year's land-rent. To become more productive, he needs further starting capital to buy additional or better equipment.

From where can he borrow this starting capital? He cannot borrow it in the form of Vals because all the Vals in circulation correspond only to the value of the consumable goods and services that are exchanged within the community. There are no Vals representing capital. Besides, nobody has any motive to lend Vals. It is not permissible to charge usury or interest for lending them. The lender therefore has nothing to gain. Besides, all artisans are effectively in the same situation. They all need starting capital. The artisan's only available option is to borrow his starting capital from me in the form of 10 bars of gold.

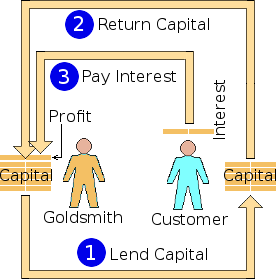

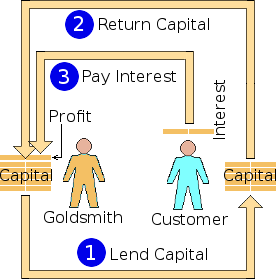

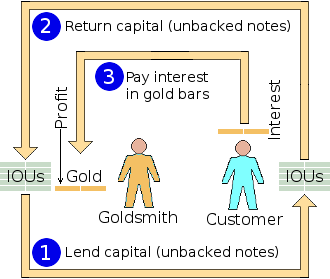

Usury: Lending Gold for Interest

But I don't do him this favour for nothing. I lend him 10 bars of gold from my vault. He uses this gold for a season, to buy his necessities, until his next sale. Then he returns 10 bars of gold to me, which I put back in my vault. However, the condition under which I agreed to lend the 10 bars to him for a season was that he return to me an extra 2 bars of the gold gained from his sale. The original 10 bars of gold is called capital. The extra 2 bars is called interest, which becomes my profit for the service of lending him the capital for the duration of the season. By this process, I gain part of the fruits of the artisan's labour. This I repeat year after year, thus gaining a steady income from him.

But I don't do him this favour for nothing. I lend him 10 bars of gold from my vault. He uses this gold for a season, to buy his necessities, until his next sale. Then he returns 10 bars of gold to me, which I put back in my vault. However, the condition under which I agreed to lend the 10 bars to him for a season was that he return to me an extra 2 bars of the gold gained from his sale. The original 10 bars of gold is called capital. The extra 2 bars is called interest, which becomes my profit for the service of lending him the capital for the duration of the season. By this process, I gain part of the fruits of the artisan's labour. This I repeat year after year, thus gaining a steady income from him.

In order to acquire the 2 bars of gold to pay me my interest, the artisan-farmer must in some way sell some of his produce to somebody who has gold bars. That has to be either me or a member of the nobility. This could be problematic for him since neither of us may have need or desire for his produce. However, we must assume that somehow he manages to get the necessary 2 bars of gold.

With the 100 bars of gold in my vault, I can lend 10 bars each to 10 artisans. Thus I gain a seasonal income of 20 bars of gold. To gain this same income, each artisan would have to sell his harvest for 32 bars of gold. And for my 20 bars of gold per season, all I have to do is keep an account in my little book.

This is considerably — considerably — less work than the artisan has to do in planting, tending, protecting, harvesting and marketing his crop. Furthermore, since the borrower be always servant to the lender, I make the artisan come to my vault to fetch and carry the gold he borrows and take responsibility for it all the time it is outside my premises. However, I'd like to help him out a little with this weighty task.

Thus from the start, the artisan's economy becomes debt-based. He can only kick-start his first production cycle by first going into debt to me to the tune of, say, 10 bars of gold. This marks the beginning of a change in the principle upon which economies operate.

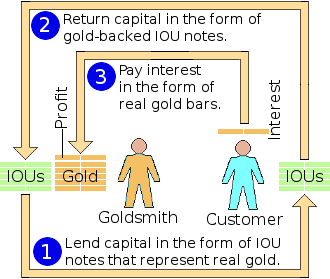

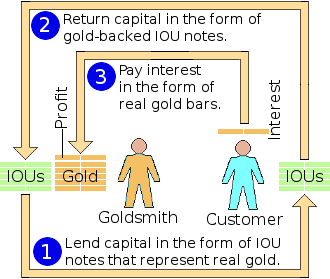

Paper Receipts to Represent Gold

Gold bars are very heavy and difficult to carry around. A person weighed down with gold bars is an obvious target for robbers. A more easily transportable form of exchange is desirable. I have an idea. Instead of lending somebody a bar of gold, I can just give him a receipt for the bar of gold I have lent to him. The gold bar remains in my vault. The receipt verifies that the value of that bar of gold is now in the possession of the borrower.

Gold bars are very heavy and difficult to carry around. A person weighed down with gold bars is an obvious target for robbers. A more easily transportable form of exchange is desirable. I have an idea. Instead of lending somebody a bar of gold, I can just give him a receipt for the bar of gold I have lent to him. The gold bar remains in my vault. The receipt verifies that the value of that bar of gold is now in the possession of the borrower.

The borrower can then pay for goods with the receipt because the seller of the goods knows he can always bring the receipt back to me any time he wants to and I will exchange it for the real bar of gold. So the receipt (or IOU note) is, in effect, as good as gold but much easier to carry around.

For each of my 100 bars of gold I therefore create an IOU note to represent its value. The next time the artisan comes to borrow 10 bars to buy his inputs for the season, I give him 10 1-bar IOU notes instead. At the end of the season, when the artisan has sold his harvest, he returns to me the value of 12 bars of gold. This can be any mix of my IOU notes and real gold bars that he has received in payment for his harvest. The total additional value that I receive as interest, from all the artisans to whom I lend, must necessarily be in the form of real gold bars.

For each of my 100 bars of gold I therefore create an IOU note to represent its value. The next time the artisan comes to borrow 10 bars to buy his inputs for the season, I give him 10 1-bar IOU notes instead. At the end of the season, when the artisan has sold his harvest, he returns to me the value of 12 bars of gold. This can be any mix of my IOU notes and real gold bars that he has received in payment for his harvest. The total additional value that I receive as interest, from all the artisans to whom I lend, must necessarily be in the form of real gold bars.

The reason the interest must be in real gold is as follows. The interest is an amount of value that I gain over the season. Therefore it was not part of the gold I had at the beginning of the season. Therefore the bars of which it consists do not yet have IOU notes representing them. Therefore the value of 2 out of every 12 bars I receive at the end of the season must be in the form of real gold bars. However, once I have received these interest bars of real gold into my vault, I create a 1-bar IOU note to represent each one. Consequently, if I ever lend them out, I give to the borrowers the corresponding IOU notes. The bars themselves need never leave my vault again.

Of course, I need to spend 1 gold bar of the interest I receive in order to buy my needs of life. So I can hoard only the remainder of the interest I receive. Nevertheless, I can buy my needs of life with my own IOU notes, which my suppliers accept as if they were gold. Any of my suppliers could, at any time, come to me and demand real gold bars in exchange for their IOU notes. However, an interesting observation is that they rarely do so. Therefore the real gold stays in my vault. The increasing proportion of what circulates as the currency of exchange within my local community is my IOU. This means that, as the years pass, more and more of the gold, that exists within my local community, gravitates to my vault.

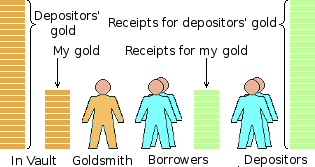

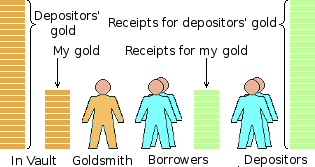

People who deposit gold in my vault for safe-keeping I call depositors. They possess an IOU note for every bar of gold they have deposited in my vault. The artisans (and whoever else I lend gold to) I call borrowers. They have one IOU note for each bar of gold I have lent out to them. The borrowers, though, are in debt to me for the amount they have borrowed.

Remember that I originally named each depositor on the IOU note I gave him. This is awkward because it means that only he himself can bring it back to me to exchange for the gold he deposited. If I were to give him instead an unnamed IOU like the ones that represent my own gold, the depositor could spend his IOU in exchange for goods. In other words, it too could circulate as a means of exchange. So I make every IOU generic, without naming its recipient upon it.

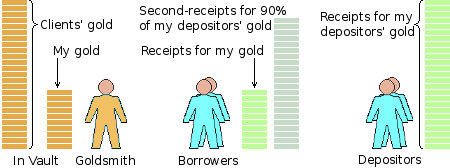

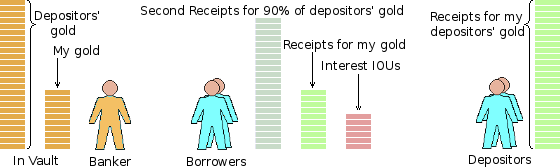

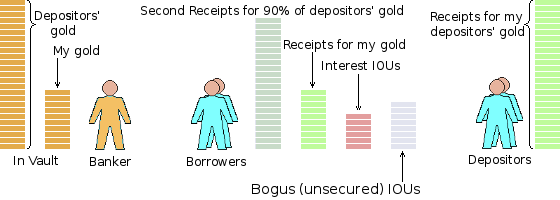

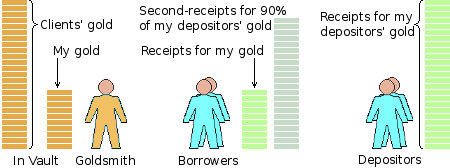

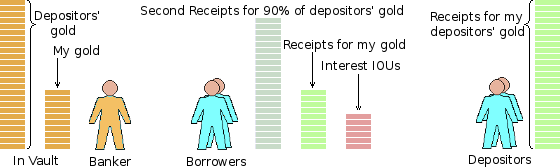

So far, I am profiting from my work as a goldsmith (making ornaments and other objects from gold), charging people for the safe-keeping of their gold and charging interest to borrowers for lending them my gold. However, I do not myself yet have much gold to lend. I cannot become rich this way. But I have noticed something over the years so far. I see that, at any given time, never more than 10% of my depositors ever come to me with their receipts and demand their gold bars back. This means that 90% of all my depositors' gold remains permanently in my vault. This is far more gold than I myself own.

Suppose I were to lend out 90% of my depositors' gold to my borrowers. My depositors would never miss it and my borrowers would be unaware as to from whence it came. I would therefore gain interest each season on 100% of my own gold and on 90% of my depositors' gold. Now this could make me very rich. I therefore create a second-receipt or IOU note for each of 90% of the bars of gold in my vault that are owned by my depositors.

I can now also lend out these second-receipts or IOUs to borrowers as if they were real gold bars. I will always have the spare 10% of my depositors' gold bars in my vault ready to give back to the 10% of my depositors who may come from time to time to exchange their IOUs for their real gold bars.

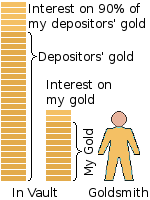

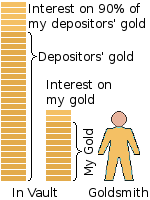

My annual income from usury has thus greatly increased. I gain interest on lending out my own gold + interest on lending out up to 90% of my depositors' gold. I am now gaining interest for myself by lending what is not mine to lend. In other words, I am committing a fraud. At this point, I decide to stop being a goldsmith. Melting and forming gold requires a lot of skill and paraphernalia. And compared with the interest I gain lending out my IOU notes, making gold ornaments is time-consuming and relatively unprofitable. So I now devote all my time to usury. I have become a banker.

My annual income from usury has thus greatly increased. I gain interest on lending out my own gold + interest on lending out up to 90% of my depositors' gold. I am now gaining interest for myself by lending what is not mine to lend. In other words, I am committing a fraud. At this point, I decide to stop being a goldsmith. Melting and forming gold requires a lot of skill and paraphernalia. And compared with the interest I gain lending out my IOU notes, making gold ornaments is time-consuming and relatively unprofitable. So I now devote all my time to usury. I have become a banker.

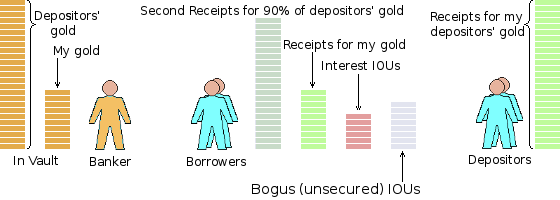

The beauty of this scam is that I don't only charge interest on the gold bars I lend, as represented by gold-backed IOU notes. I also charge interest for lending what is represented by unbacked IOU notes, which is, absolutely nothing! So, at the end of the season, I receive 2 real gold bars for every 10 unbacked IOU notes I lent out. That is, my profit consists of 20 real gold bars for lending 100 gold-backed IOU notes + 180 real gold bars for lending 900 unbacked (or bogus) IOU notes. So I gain 180 real gold bars for lending what is, in effect, nothing.

The beauty of this scam is that I don't only charge interest on the gold bars I lend, as represented by gold-backed IOU notes. I also charge interest for lending what is represented by unbacked IOU notes, which is, absolutely nothing! So, at the end of the season, I receive 2 real gold bars for every 10 unbacked IOU notes I lent out. That is, my profit consists of 20 real gold bars for lending 100 gold-backed IOU notes + 180 real gold bars for lending 900 unbacked (or bogus) IOU notes. So I gain 180 real gold bars for lending what is, in effect, nothing.

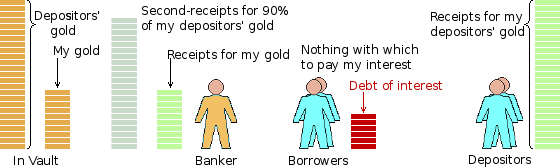

Issuing written promises to pay what I actually do not have is a fraud. This is a crime second only in graveness to murder. But it's OK because I am now a banker. So it is publicly acceptable for me to commit this on-going fraud. It is, however, a meticulously well-managed fraud. This is because I have in my vault enough gold to pay off all my depositors and I could use my own gold to pay in gold some of the creditors whom my borrowers paid for goods or services with my IOUs. I would only have to default on paying the suppliers of my borrowers who paid with the second-receipts issued on 90% of my depositors' gold. It would be just hard luck on them in the unlikely event that everybody at once wanted their real gold bars back. So I'm fairly safe — for now.

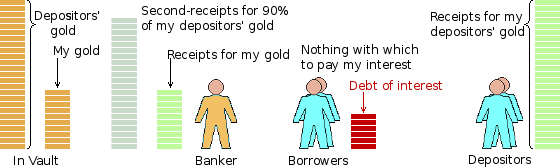

I am now well established. I have in my vault 100 bars of my own gold and 250 bars of my depositor's gold. My depositors have 250 of my IOU notes backed by their gold in my vault. My borrowers have 100 IOU notes backed by my gold in my vault. My borrowers also have 225 IOU notes that are not backed by gold in my vault.

The suppliers of my borrowers naïvely trust that the IOU notes, with which my borrowers are paying them, represent real bars of gold in my vault. But in reality, only 350 [61%] of the IOUs I have issued to my customers are backed by real gold bars. All the rest are promises to pay what does not exist. But so long as everybody continues to have their naïve confidence in my IOU notes, nobody will be any the wiser and I can keep on gaining interest on all the IOU notes that I lend to my borrowers.

Interest Fuels Inflation

Of course, all the interest I receive is necessarily in addition to what I lend out. Consequently, it cannot be paid to me in the form of my own IOU notes. It has to be paid in real gold. The problem is that over the years, all the available gold in my local community has already been received by me as interest payments. It has all gone into my vault. So, with my local community now completely sucked dry of all its gold, with what can my borrowers pay to me interest when it becomes due?

Could my borrowers simply charge higher prices for the goods they sell so that they will have sufficient currency left to pay my interest? No, because considering the community as a closed finite economy, the buyers of their goods would, collectively, have insufficient IOUs with which to pay the higher prices.

[I shall consider my local community to have a closed finite economy for a reason that will become apparent later. Please bear with me.]

Could my borrowers (the producers in the community) simply increase production so they could sell more at the original prices? No, because collectively, their customers have no more IOUs with which to buy the extra goods (always assuming they need the extra goods anyway).

It does not matter whether or not the community as a whole increases production or prices. There is only a limited amount of my IOUs with which members of my community can effect their trading exchanges.

I could accept my interest in kind. In other words, each of my borrowers could give me some of the goods he has produced instead of IOUs. But then I would be inundated with a wide variety of goods or services that I did not want or need.

I really want to receive my interest as gold bars or as my IOU notes that represent gold bars. But there is no more gold left among the members of my community. And all the IOUs I lent out as capital (or principal) have come back to me as repaid capital. There are no IOUs left to pay the interest that has accrued upon this capital. So what do I do?

Creating Debts of Interest

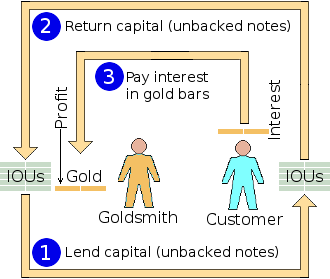

I create (or print) some more IOU notes. I create IOU notes that represent the value of the number of gold bars (red below) that I am owed in interest by all my borrowers. Then I lend these new IOU notes to my borrowers, which they then use to pay me the interest.

All a borrower's debt of interest will remain a debt that must be paid off in the future. In the meantime, that debt itself will continually accrue interest.

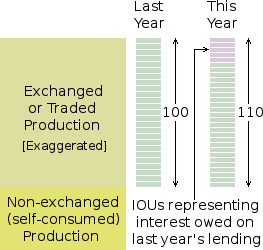

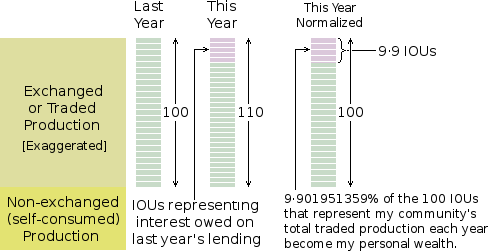

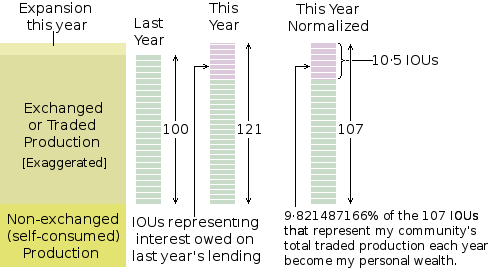

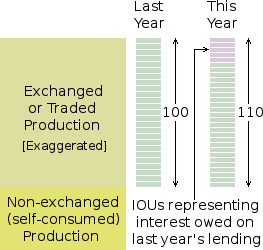

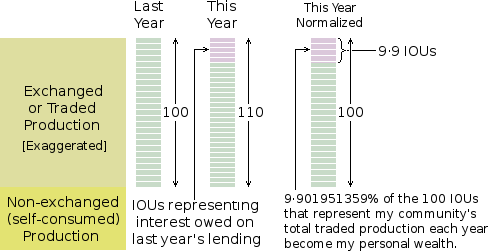

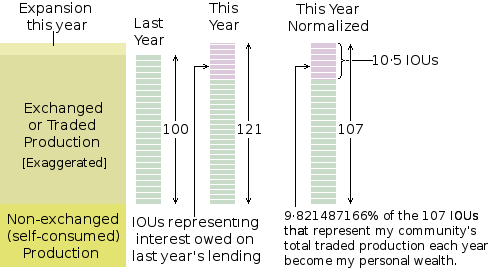

The effect of my lending these new IOUs into the community is as follows. Suppose my community's traded production last year was represented by 100 of my IOUs that I lent to my borrowers at 10% interest. My borrowers must therefore repay me the 100 IOUs they borrowed + 10 IOUs in interest. But they can't pay the 10 IOUs because they don't exist. So I create them and lend them. As a result, this year's traded production will be represented by 110 of my IOUs. This is still true whether production increases, decreases or remains the same. To simplify my explanation, I will assume that total traded production stays constant.

The effect of my lending these new IOUs into the community is as follows. Suppose my community's traded production last year was represented by 100 of my IOUs that I lent to my borrowers at 10% interest. My borrowers must therefore repay me the 100 IOUs they borrowed + 10 IOUs in interest. But they can't pay the 10 IOUs because they don't exist. So I create them and lend them. As a result, this year's traded production will be represented by 110 of my IOUs. This is still true whether production increases, decreases or remains the same. To simplify my explanation, I will assume that total traded production stays constant.

In this case, the fixed amount of produce, that was represented by 100 of my IOUs last year, is now represented by 110 of my IOUs. But produce has an intrinsic value as a human need. For example, a loaf of bread has a constant intrinsic value determined by its ability to nourish a human being. The result is therefore that the value of each of my IOUs has diminished. Its value has shrunk. This, of itself, is not too significant. It simply means that the same quantity of real goods and services that are exchanged within my community is now represented by more pieces of paper.

The significant outcome of this process is that, year-by-year, I am siphoning off a proportion of the community's traded production into my own personal reservoir of wealth. And all in return for false promises written on pieces of paper. I am accumulating wealth in return for absolutely nothing. At about this stage, my depositors perceive that I am using their gold as collateral against which I have created "unbacked" IOUs. Consequently, they do not see why they should pay me to store their gold. There is a danger that they may withdraw it. I appease them by waiving the charge I make for keeping their gold in my vault. Instead, I decide to pay them 1% interest per year for the privilege of being able to use it as collateral for my "unbacked" IOUs.

The Wealth Siphon

The upshot of my little scam is that, year by year, a proportion of my local community's gross annual product simply falls into my lap. I lend out 100 IOUs to the artisans of my local community. I charge 10% interest. That is 10 IOUs. This is payable at the end of the year along with the return of the 100 IOUs of capital. But the artisans of my community cannot pay me the interest because they only have between them the IOUs I lent to them at the beginning of the year. Remember that it is a closed community. They can only buy and sell among themselves with the 100 IOUs they have. As a whole, therefore, the artisans can gain no IOUs by selling their produce.

I discontinue the option for my debtors to pay me in kind. I no longer accept cows and sheep as interest payments. I print the 10 IOUs my debtors owe me. I then lend these to my debtors. I then receive them all back again from my debtors in settlement of their debts of interest on the capital they had borrowed. I am now free to spend these IOUs with the artisans of my community to buy my needs of life. Yet, although I have spent them in return for goods and services received, interest payable by the artisans at the end of the coming year is accruing on them. I am thus earning interest on the capital for the current year, plus interest on the interest on the capital from previous years. If I charge 10% interest on what I lend to my local community each year, for 12 years, interest accrues as follows.

| Year | Capital | Int on Cap | Int on Int | Total Int | Mine

|

|---|

| 00 | 100 | 10 | 0 | 10 | 9·090909091%

|

| 01 | 110 | 11 | 1 | 12 | 9·836065574%

|

| 02 | 122 | 12·2 | 1·2 | 13·4 | 9·896602659%

|

| 03 | 135·4 | 13·54 | 1·34 | 14·88 | 9·901517168%

|

| 04 | 150·28 | 15·028 | 1·488 | 16·516 | 9·901916113%

|

| 05 | 166·796 | 16·6796 | 1·6516 | 18·3312 | 9·901948498%

|

| 06 | 185·1272 | 18·51272 | 1·83312 | 20·34584 | 9·901951127%

|

| 07 | 205·47304 | 20·547304 | 2·034584 | 22·581888 | 9·901951340%

|

| 08 | 228·054928 | 22·8054928 | 2·2581888 | 25·0636816 | 9·901951358%

|

| 09 | 253·1186096 | 25·31186096 | 2·50636816 | 27·81822912 | 9·901951359%

|

| 10 | 280·9368387 | 28·09368387 | 2·781822912 | 30·875506784 | 9·901951359%

|

| 11 | 311·8123455 | 31·18123455 | 3·087550678 | 34·268785229 | 9·901951359%

|

| 12 | 346·0811307 | 34·60811307 | 3·426878523 | 38·034991596 | 9·901951359%

|

Inflation is rampant. In Year 0, the value of my community's total traded production is represented by 100 of my IOUs. By Year 7, that same value of total traded production is represented by over double that number of IOUs. In other words, in the 7th year, my IOU has shrunk to less than half its Year 0 value. By Year 9, the annual slice Mn of my community's total traded production that falls into my possession, by this mechanism, has stabilized at a somewhat irrational 9·90195%, which, in the general case, is given by the following equations.

- Mn = Tn ÷ (Cn + Tn)

- where:

- Cn = Cn-1 + Tn-1

- Tn = R × (Cn + Tn-1)

- key:

- C is the capital (money supply) for the year indicated by its subscript,

- T is the total interest accrued for the year indicated by its subscript,

- R is the rate of interest, expressed as a decimal fraction.

A collateral effect of my usury is that, at the end of each year, each IOU is worth only Cn/(Cn+Tn) = 90·098048641% of what it was worth at the beginning of the year. Its value has diminished. This is called 9·901951359% inflation. I think that inflation is a confusing and inappropriate term. It is prices that inflate. But this is not because products become more valuable: it is because the unit of money — in this case the IOU — shrinks in value. I think that logically, therefore, it should be called deflation. The monetary unit is like a leaking balloon that is deflating. It gets progressively smaller in value.

A Shrinking Yardstick

In the past, people measured lengths and distances in a unit called the yard. A yard was equivalent to 0·9144 metres. It was about the length of the pace of an average man. A common measuring instrument was the yardstick. This was a piece of wood cut to be exactly a yard long. The whole idea was that all yardsticks should be identical in length. Fred in Manchester could then write to Jim in London and tell him how many yards long the piece of cloth was that he was about to send from Manchester. Jim could then check it with his yardstick on its arrival in London. Assuming Fred and Jim were both honest men, their measurements would agree. Similarly, if Jane were to read an ancient letter written by Gertrude two centuries before in which she stated the length and breadth of her dining room, Jane would know exactly how big Gertrude's dining room had been. The yard was an invariant unit of measure that was independent of time and place.

The idea of invariant units of measurement is key to all branches of science and engineering. Volts, amps, joules, farads, henries, gauss, hertz, newtons, grams, metres, seconds are all units of measurement that owe their usefulness to their invariance. There is, however, one unit of measure that is not like this. It is the unit of monetary value such as the Euro, dollar, Libra or yen. These are like rubber yardsticks. Using them to measure value is like using a sausage-shaped balloon that is gradually deflating to measure the lengths of things. You'll never get the same answer twice. Measured this way, Fred's cloth would be a different length by the time it got to London, even though nothing had materially changed. This is why many rationally-thinking people find it very difficult to get their head round how money works — or rather doesn't work.

Consequently, to me, money is a paradox — an arbitrary yardstick, of capricious elasticity, used by those with economic power to compare an immense diversity of like against unlike, in terms of one single dysfunctional universal measure that has no basis in physical reality.

The closest natural analogy to money I can think of, is a radioactive material whose elements [atoms] decay spontaneously into lighter elements [smaller atoms] plus fissile products comprising alpha particles, neutrons etc. and radiant energy [generally gamma rays]. A radioactive material is thus said to have a half-life, which is the time it takes for the original material to halve its substance as a result of radioactive decay. Analogically, the value of a monetary unit decays at a certain rate. Thus, for example, the British pound could be said to have a half-life of about ten years. The difference is that monetary value decays into nothing: aliquid in nihilum. But as it decays, the Gods [the bankers] create more of it, out of nothing: creatum ex nihilo, so they always have more money to lend and spend.

Pragmatic observation demonstrates clearly to me that money has little or no bearing on work, virtue or merit. On the contrary, I can see it relentlessly expediting its indisputable purpose of concentrating wealth, generated by a deluded many, into the laps of a devious few. If money be a measure of anything, it is simply a measure of hegemony, which, to my mind, has neither social morality nor economic virtue.

But its arbitrary variability is not the only thing that disqualifies monetary units as valid units of measure. Money is also used to measure quantities whose natures are fundamentally different. If you ask me how far is Manchester from London, I could answer 264 km. If you ask how fast I was travelling, I could answer 110 kph. This makes sense. I am using different units to measure different things. If I measure distance, I use kilometres. If I measure speed, I use kilometres per hour. The two are fundamentally different, yet they are mutually consistent.

Not so with money. If I ask the price of wheat, you may answer something like €200 per ton. If I ask the price of agricultural land to grow that wheat, you may answer something like €2000 per hectare. In the first case, you are using the Euro as a measure of the value of human food per unit quantity. In the second case, you are using the same unit to measure the value of something that yields a rate of production of human food, such as 1·7 tons/hectare/year. So land should be valued in a unit whose dimensions are Euros/hectare/year; not simply Euros. A Euro is not the same thing as a Euro per hectare per year. Yet people use the same monetary unit to measure both. The world of money is littered with such dimensional inconsistencies — and people wonder why we have economic crises. Imagine the confusion of physical impossibilities if science measured mass, force, distance, speed and acceleration all in the same unit.

Normalization

Explaining what I do next is going to be impossibly difficult if done in terms of this rubbery unit of value measurement. To overcome this problem, I am going to subject this rubber yardstick to a process called normalization. This gets rid of interest-generated inflation without getting rid of its effect of transferring a proportion of my community's annual traded production into my pocket.

It is accomplished as follows. I add Tn new interest-IOUs to the Cn IOUs already in circulation to get the inflated number Cn+1 that represents my community's fixed value of traded production for the year. I then destroy the Tn IOUs that I receive back as interest payments from my debtors. Cn IOUs then, once again, represent my community's traded production. Finally, I take from each artisan in my community Tn÷(Tn+Cn) — the 9·901951359% — of the Cn IOUs that he has in his possession.

Of course, I can't do this physically. I would need to be able to divide each IOU to about the tenth decimal place. It could be done with a computer-based currency. Notwithstanding, normalization conceptually solves the problem of interest-based inflation. The fixed amount of annual traded value in my community remains represented by a fixed number of monetary units, while I still gain possession of the proportion of those non-inflating IOUs that represent my interest charges. And that is what I need in order to explain the next phase of my shenanigans.

Expanding The Economy

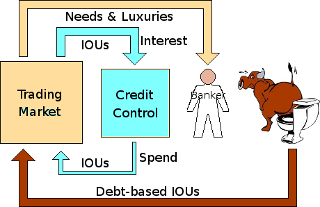

Under the current economic structure of my local community of artisans, I have gone as far as I can. Notwithstanding, being now a banker, I have in mind an even more lucrative scam. In order to be able to implement it, however, I first need to somehow persuade, deceive or inveigle the artisans of my community into making a radical change to their economic modus operandi.

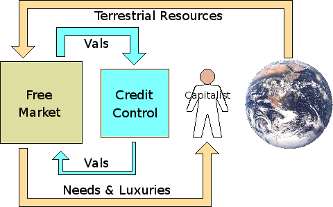

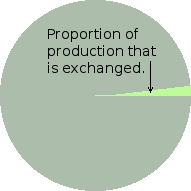

The tenant artisan-farmer produces pretty well all his basic needs of life on his own rented land. At least, he can do so whenever he wishes. He only needs to buy from afar when he lacks something because of a bad season due to pest, drought or bad weather. He only has an opportunity to sell something when he has had an exceptional season and somebody far off has had a bad season. Consequently, only a small proportion or fraction of the total production of the land ever needs to change hands. So very little ever passes through the market.

This tiny proportion or fraction of the goods produced that actually changes hands is illustrated on the left. This tiny amount of exchange is facilitated by very few Vals, gold bars or IOU notes. There is thus no need to have very many Vals, gold bars or IOU notes per head of population circulating within the community. Furthermore, once he has become well established, the artisan-farmer need only save about a twentieth of the seed from his harvest to plant for the next. His need to borrow from me then evaporates, and therefore so does my income from interest charges.

This tiny proportion or fraction of the goods produced that actually changes hands is illustrated on the left. This tiny amount of exchange is facilitated by very few Vals, gold bars or IOU notes. There is thus no need to have very many Vals, gold bars or IOU notes per head of population circulating within the community. Furthermore, once he has become well established, the artisan-farmer need only save about a twentieth of the seed from his harvest to plant for the next. His need to borrow from me then evaporates, and therefore so does my income from interest charges.

This situation is not conducive to my scam. Somehow, I need to create a demand for more of my gold bars to be in circulation. Then the community as a whole will need to borrow more gold bars from me. As a result of interest payments all of the limited number of gold bars that exist in my local community are now in my vault. Circulating in their place are my gold-backed IOU notes, plus the unbacked notes that represent 90% of my depositors' gold. For my scam to work, I need a way to increase the number of IOU notes circulating within my local community. I need to greatly increase the number of IOU notes per head of population. But how can I achieve this?

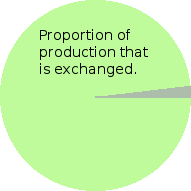

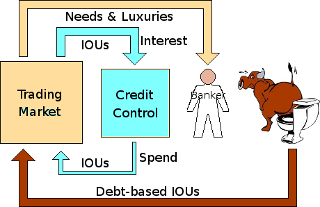

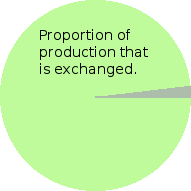

I need the number, and therefore the total value, of goods per season that are actually exchanged to greatly increase. For this to happen, the fraction or proportion of my local community's total production that actually changes hands needs to vastly increase. For this to take place, the artisan-farmers of my local community must become much less self-sufficient. They must become vastly more inter-dependent. They must have need of each other's produce. Then, practically all of the community's production will change hands. It will be bought and sold via the market. This will vastly increase the demand for my IOU notes.

I need the number, and therefore the total value, of goods per season that are actually exchanged to greatly increase. For this to happen, the fraction or proportion of my local community's total production that actually changes hands needs to vastly increase. For this to take place, the artisan-farmers of my local community must become much less self-sufficient. They must become vastly more inter-dependent. They must have need of each other's produce. Then, practically all of the community's production will change hands. It will be bought and sold via the market. This will vastly increase the demand for my IOU notes.

But how can this change be brought to pass? The key to bringing about this change is specialization.

Becoming Specialised

Physical and mental aptitudes, and the skills that can be developed from them, are naturally distributed unevenly throughout a human population. This makes some people good at some things and other people good at other things. An individual is necessarily more efficient and productive when doing what he is naturally good at. He also finds it easier. Hence natural human laziness — taking the line of least effort — is essentially what drives economic specialization.

All the artisans therefore naturally gravitate from self-sufficient generalists to interdependent specialists. All I have to do is encourage them into becoming more and more specialized in the work they do. I specialized as a goldsmith, then as a banker. Others specialize as blacksmiths, coopers, wheelwrights, carpenters, butchers, bakers and candlestick makers — each abandoning his generalised skills for growing his broader needs of life on his own rented land.

Nevertheless, however productive he may become as a specialist in his chosen trade, the artisan still needs the full range of the needs of life. He has now become a specialised producer but he is still — and always must be — a generalised consumer. He must now therefore buy from the market pretty well the full range of the human needs of life. When the artisan was self-sufficient, his needs of life did not pass through the market. They went straight from his field to his barn and from his barn to his table. They therefore didn't need Vals, gold bars or IOU notes to represent their exchange value. Now, all the community's needs of life pass through the market. They all therefore need their value to be represented by Vals, gold bars or IOU notes. And this requires there to be a lot more money in circulation.

But where does this money come from? It could come from the same place Vals came from. People could simply write them as IOUs for goods provided, which could then be further exchanged for other goods elsewhere in the community. This, however, is no longer an option.

Segregation of Skills, Mutual Distrust

When artisans are self-sufficient in the basic needs of life, each has a full appreciation of the work and effort involved in producing these basic needs. Each therefore knows intuitively, from personal experience, the worth of the other's product. This provides a conduit for mutual trust and broad social interaction. Each therefore readily agrees with the other's sense of value, that is, the number of Vals he is asking, in exchange for a particular product.

Once artisans begin to specialise and abandon their general skills, each begins to lose his working knowledge of what the other does. Artisans no longer share the common ground needed for each to be able to appreciate how easy or difficult the other's work is relative to his own. Each, therefore, no longer possesses the context for assessing the relative value of the other's product. Each, naturally, tends to over-estimate the value of his own product relative to that of the other. Consequently, the prices of specialised products begin to leap-frog, thus placing an inflationary pressure upon the once-stable Val.