When scanning the panorama of history, the Limited Liability Company came on the scene only very recently. Only 140 years ago in fact. For a long time, wealthy men have pooled their resources in joint commercial ventures that would be too large and risky for any one of them to do alone. To do this they formed what were called Joint Stock Companies. It was not until 1844 that an Act of Parliament was passed to impose a set of formal rules by which Joint Stock Companies should operate.

The immense power of such co-operations usually gained great fortunes for all concerned. But by pooling their wealth, the participants in a Joint Stock Company also pooled responsibility. Therefore, a mistake by one of them could lose not only his own wealth, but also that of each of his fellows. The elite of the land decided therefore that this was not fair. In the 4 years from 1855 to 1858, they therefore lobbied Parliament which, as a result, passed the Limited Liability Act, made various amendments to the Joint Stock Companies Act, and finally passed 'an Act to enable joint stock companies to be formed on the principle of limited liability'. Various Companies Acts have been passed since. But these were only to correct and circumvent anomalies and to rationalise and consolidate the law. They did not alter the fundamental principle of limited liability.

The limited liability company is a powerful construct. Legally speaking, it is an artificial person whose existence and identity are separate from those who own it. It has legal rights. It has legal duties. It can own and transfer property. It can enter into contracts. It can sue and be sued. It can be prosecuted for crimes. It can become bankrupt. And it can die. So when you do business with a limited liability company, you are not doing business with its owners. Neither are you doing business with its employees or representatives. You are doing business with a ghost.

How It Works

The capitalist advances capital to start a new venture. This new venture is incorporated as a limited liability company. The capital he advances is however, only a part of his total personal wealth. It is also only part of the capital advanced to his company. Others of his kind also advance part of their wealth to capitalise the company. Thus they share the cost of starting the company, and thus together become its owners or share-holders. They have created a wealthy ghost to take their risks for them.

As the company begins to make a profit, its shareholders begin to draw out some of this in the form of salaries and dividends. Part of what they draw they live on. The rest they accumulate into their personal capitals. Consequently each shareholder's personal capital just grows and grows. The portion of the profit they leave behind swells their company's own capital. Their ghost itself also thus becomes ever richer, and is able thereby to wield ever more commercial power within the market.

In any free-market trading relationship, it is always the stronger party who dictates the terms. The joint-capitalised limited liability company is inevitably stronger than the individual consumer or the sole-trading supplier. So it is always the joint-capitalised limited liability company — the wealthy ghost — which dictates the terms of business. It is his terms and conditions of sale to which the consumer must agree. It is his terms and conditions of purchase that the sole-trading supplier must sign. It is his contract of employment to which his employees must submit.

For example, the large company usually requires the consumer to pay for goods in advance of receiving them. In many cases companies demand payment for finished goods from the consumer before they will even order the raw materials with which to start making the goods. On the other hand, the limited liability company demands that the supplier deliver goods to it long before it pays for them. Even when it agrees in writing to pay in 30 days, it will still not have paid 90 days afterwards. Our commercial ghost thinks nothing of reneging on such agreements, and does so constantly, openly and without shame of failed obligation. And the labourer is paid a week or a month in arrears, or, in the case of the part-time jobs of the 1990's, when and if the employer feels like it.

So at any given time, the joint-stock limited liability company has in its possession, goods for which it has not paid + money for which it has not supplied the goods + labour for which it has not provided wages.

The value of this money + the value of these goods + the value of this labour act as additional capital within the company. And this allows the company to expand further and increase its total profit. The company's shareholders therefore make a profit not only from the capital they have put into the company, but also from the capitals that they are constantly withholding from their customers, suppliers and employees. Therefore, though they themselves have no legal share or say in the running of the company, these customers, suppliers and employees have become unwilling but nevertheless substantial providers of its working capital.

Legalised Theft

That part of a small sole-trader supplier's capital that is being withheld by a company cannot be deployed by its rightful owner in the process of turning his labour into his needs of life. Such a company is therefore depriving the capital's rightful owner of the profit it could generate for him if it were in his possession. The company is therefore stealing that profit. Withholding capital is stealing profit. Late payment is theft. But of course, in a country whose laws exist for the purpose of protecting and furthering the cause of the rich, it is not legally deemed to be theft.

However, compared with what is to come, withholding payment is only petty theft. If his venture later goes bankrupt, and ends up with debts it cannot pay, the capitalist, protected by his limited liability is liable only for the amount of the capital he has in the company at the time. All his personal capital — including that part of it which was accumulated from the profit and salary he took from the company — is safe. He cannot be forced to use it to recompense those to whom his bankrupt company owes money or goods. His company may be bankrupt, but he himself is not. He is free to use the capital he has gained from his failed company to start a new one, leaving his unfortunate creditors to bear his losses.

In reality, the source of this capital is the sad body of people to whom his failed venture owes goods and money. His suppliers who provided his failing venture with its materials and equipment for which they were never to be paid. His customers who paid him in advance for finished goods which they were never to receive. His labourers who worked for wages in arrears which they were never to be paid. It is their capital: their money, their goods, their labour which establish his new venture.

His new venture therefore strictly belongs to them. And so it would do, were it not for this devious law of limited liability. A law created by the rich for the rich. A law that legalises theft by the rich from the poor.

As well as protecting him against the ravages of trading in a global free market, his limited liability company also provides the capitalist with a wall behind which to hide his identity. A limited liability company has a separate legally established name of its own, which has no need to bear any resemblance to that of its owner. As individuals, the true owners of a company may be completely unknown to its customers and suppliers. And they are probably no more than vague and aloof shadows to those whose labour actually powers their enterprise. So although the name of a failed limited liability company be cursed to the four winds, its former owners themselves are free to launch a new one whose name shall be unstained by the great theft they have perpetrated upon their creditors.

Limited liability is purported to have been created as a defence against misfortune. However, once established, it was soon realised by astute capitalists that it could be used positively as an effective mechanism for concentrating the wealth of the many into the hands of the few.

Stolen Wealth

The global free market, by its nature, offers many opportunities for high profit. But the higher the potential profit, the higher is the risk of losing everything. And the higher the risk, the shorter is the life-expectancy of any venture that embarks on a pursuit of that profit. One of the given justifications for the introduction of limited liability is that without it not a single individual would ever have taken the risks required to embark on the ventures that brought into being modern industrial society.

The limited liability company thus enables the capitalist to embark on high risk high profit ventures without the fear of personal ruin. Like the ever-expendable American police dog, it boldly gallops before him into the mêlée ready to take the bullets of misfortune on his behalf. However, being a ghost, it cannot stop these bullets. It merely deflects them into the bellies of its creditors — its customers, its suppliers, its employees. It is they who suffer the consequences of its misfortune. It is they who take the risks on behalf of the capitalist whom the company protects.

Thus protected, the capitalist scans the marketplace for opportunity. Suddenly he sees one materialise out of the maelstrom. The potential profit is high. But the risk is great. To seize it he must act quickly, else others will take it from him. Time is short. He must get his hands on a lot of capital very quickly — more than he himself would care to risk on such a dubious venture. He persuades other capitalists to go into it with him. Together they form a joint stock company with limited liability. They acquire premises, machines, materials and labour and set them to work. They sell the goods they produce and high profits start to roll in. The capital within their company begins to grow exponentially.

The nature of the free market dictates that there is only an optimum size to which their venture can grow and still employ its capital at maximum profitability. If it becomes too big and produces more than the market can consume, then the price of its goods is forced down and the return on its capital diminishes. They therefore take their excess capital out of the venture in the form of salary increases and personal expenses, leaving within it only as much capital as is necessary to produce its goods at a rate that will just satisfy market demand.

As the company's power and dominance grows, so too therefore does the proportion of its working capital that is furnished by its unsecured creditors — its customers, suppliers and employees. And so too does the capital that is siphoned off into the private accounts of its shareholders.

But these high-risk high-profit opportunities that materialise suddenly out of nowhere are invariably driven by fashion. So, when the market's attention is attracted away by some new fad of the moment, demand for their offering disappears as suddenly and as unpredictably as it came.

It leaves little time in which to act. When the demand for their product begins to wane, the capitalist owners of the venture therefore increase their salaries and expenses. This drives the company's apparent profit down. This reduces the value of their shares and hence their liabilities to the company. Finally their market collapses. Revenue ceases. The company cannot continue. It ceases trading. It declares bankruptcy.

The total value of its owners' shares is not sufficient to cover the debts the company owes its suppliers, customers and employees. Its suppliers lose the goods they have supplied to it on credit. Its customers lose the money they have advanced for products yet undelivered. Its employees lose their wages for the work they have done since last they were paid. While its owners walk away freely with all the capital they took from it in salaries, expenses, bonuses and dividends all the time it was trading.

The result is that the capitalist owners of this limited liability company have increased their own personal capitals not only from profit gained from the market, but also at the expense — and often the ruination — of their smaller and weaker customers, suppliers and employees. Wealth has thus been stolen from the poor and the weak and concentrated into the hands of the rich and the powerful.

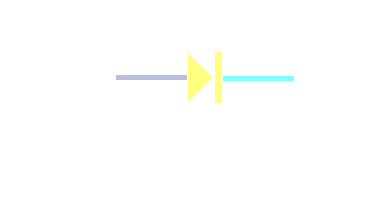

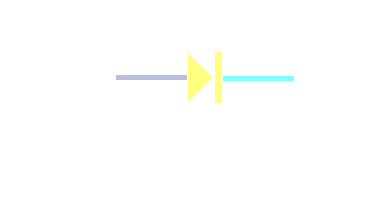

The limited liability company is thus like a one-way valve or electronic diode. It allows wealth to flow from its market and unsecured creditors into the private domains of its capitalist owners, but not the other way.

The joint-stock limited liability company has no upper restriction on its size. There are laws that theoretically oppose monopoly in any given sector of manufacture or trade. However, these are seldom invoked and are generally ineffective. Besides, there is no restriction on the number of sectors within which a single company can operate. So theoretically, one single joint-stock limited liability company could own 49% of the market share in every sector of every free-market national economy on Earth.

Such a spectre would be too obvious and threatening. However, there is no reason why a single faceless individual should not own the majority of shares in the majority of all the joint stock limited liability companies in the world. This does not seem to be so at present. Nevertheless, according to the U.N. Human Development Report 1998, the combined capital of the richest 225 people on Earth was equal to the combined income of the poorest 47% of the world population.

Companies speak of their 'market share'. What they are saying in effect is that they own, control or possess a certain percentage of the market. Though this contradicts the precepts of the free market, it is truer than it sounds. The real so-called 'free' market is not an area of common ground where individual and corporate, large and small, rich and poor can, with equal opportunity and fairness, exchange what they have for what they need. On the contrary, it is a battle-field where the dominant aggressor, driven by greed and the lust for power, employs the strategies and tactics of war to conquer, dominate and possess — or destroy.

Thus, by means of the joint-stock limited liability company, those who possessed at least some of the planet's productive resources were able to accumulate more. Gradually at first, and then ever more rapidly, this fortunate few took over, and thereby concentrated, the scattered wealth of the many. Then, once the many had nothing left, the richer took over the wealth of the less-rich in an accelerating process, which relentlessly concentrated the productive resources of the Earth into fewer and fewer hands. As a result, the economy of the world is now conducted through a global free market, which comprises a relatively small number of joint stock limited liability companies, the share holdings in which are for the most part owned by an exclusive global clique of super-rich individuals.

A Social Disrupter

Since its inception in the mid-nineteenth century, the joint-stock limited liability company has ousted both the nuclear family and the anthropological community as the fundamental building block of society. But it is not controlled by society. Ordinary people have no say in how it is run.

It has no part with democracy. It is controlled exclusively by the owners of its stock — a small band of rich capitalists who answer to nobody but themselves. It is run by a board of directors who are inevitably dominated by a single autocrat. Its power and size allows it to dominate those smaller than itself — suppliers and customers alike. Board members are usually the main shareholders, and the only option open to minority non-executive shareholders is to sell their shares. And far from being there to serve the common good, the sole reason for its existence is to further the immediate narrow self-interests of its owners.

As a socio-economic construct the joint-stock limited liability company stresses the old family unit to breaking point. It forces husband to work in one place and wife in another. It pushes the care and bringing up of children outside the family into the open market, where it is exploited as yet another commercial opportunity for making a profit. It also breaks up the natural anthropological community. Now being the only channel through which ordinary people can turn their labours into their needs of life, each is forced to work wherever the company that condescends to employ him requires him to work. Husband in one place, wife in another — increasingly requiring expensive long distance commuting.

Furthermore, with the continuing specialisation of skills brought about by the division of labour, people who have spent the best years of their lives gaining special skills and knowledge are forced to move to wherever a company with a current demand for their particular skills wishes them to move, whenever it wishes them to move. Children settled in at school are suddenly up-rooted out of season and thrust into a new place with new peers they do not know. Austere geometrical housing estates fill with neighbours who have nothing in common. From different areas with different cultures. From different social backgrounds with different values and lifestyles that are mutually incompatible. With different occupations and levels of education. All are compressed together in lonely isolation.

The joint-stock limited liability company is a reprehensible mechanism, which the Laws of England openly condone and support. It is a mechanism that has lost me thousands of pounds, while the director of one failed limited liability company with whom I traded still has his £250,000 home in the New Forest and sends his child to private school. I later discovered that he had a string of 22 failed companies to his name. As a lone hard-working honest self-employed trader who has had to support a mentally-ill wife and three children, I have no means to survive in such an intrinsically destructive economic environment.

Parent Document |

©September 1995 Robert John Morton