The profit on each item is the price for which I can sell it, less what it costs me to produce it. The daily income from my enterprise is therefore this (my unit profit), times the total number of items per day which my enterprise produces and sells.

To maximise my daily income, I must force my unit price as high as possible, my unit cost as low as possible and my rate of production (the number of units per day I produce and sell) as high as possible.

My rate of production (units per day) is set by the rate at which I can induce people to buy what I am selling. This depends on how well I can market my product, and also on what proportion of all the people in the marketplace still have not bought my product. However, having lots of capital, I am able to buy the mass-media advertising power necessary to persuade people to buy whatever — and as much as — I want them to buy.

Maximising Production & Price

The unit price I can demand for my product depends on how hungry for my product the market is at the moment. The market is at its most hungry for a product roughly when half the people who are ever likely to buy one have not yet done so. That is, when the population of my product within society at large is about half of what it will be when everybody who is ever going to buy one has done so.

Under the influence of effective marketing, the market population P of a given product starts off small and grows to a maximum in the manner shown by the following curve.

This curve is generated by the Standard Logistic Difference Equation shown below the curve. It gives the market's total product population today (Pnew) in terms of the market's total product population yesterday (Pold). P is expressed as a fraction of the total possible population of the product within the market. That is, the maximum number of copies of the product that will ever be in the possession of customers. The k factor is a measure of the power and effectiveness of my enterprise's combined marketing, production and distribution processes.

The curve rises slowly at first because although potential demand from the 'empty' market is high, the product is not yet widely known. But as the marketing process takes effect and production gets going, the rate of consumption of the product by customers accelerates, so the curve becomes ever steeper. It remains at its maximum steepness during the period when everyone who wants the product is scrambling to buy one. Finally when most people who want one have one, consumption rapidly falls back to zero. The curve therefore flattens out and remains flat. The market is now what is termed 'saturated' with this product.

The point at which the population of the product, within society at large, is about half of what it will be, when everybody who is going to buy one has done so, is also the point at which its potential rate of consumption — and consequently its rate of production — are at a maximum. So the criterion for maximum price is the same as that for maximum production. By driving up consumption, I will therefore automatically be able to drive up the price also.

However, it is not the actual population of the product within its market that is of interest to me. It is the rate at which the product's population is increasing within its market that matters, ie: its rate of growth.

Rate of Growth

The product population curve shows the actual population of the product within the market at any given time. So the slope of the curve shows the rate at which the market population of the product is increasing at any given time. In other words, the slope of the curve is the rate at which the market is consuming the product (in units per day). It is also, by default, the rate at which the product is produced and sold (also in units per day).

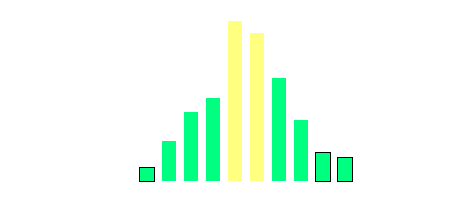

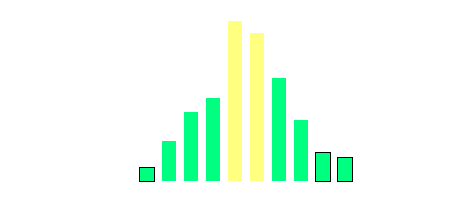

By plotting another graph showing how the slope of the product population graph rises and falls, we get a curve showing the rise and fall in the rate of consumption (and hence the rate of production required to meet that consumption). This curve is shown below.

This curve however shows only the part of the rate of production that causes the market population of the product to grow initially. After a time, the product units that are already out there in the market start to wear out and need replacing. Therefore another smaller element of production is required by the market to replace old product units as they wear out and die.

The product death rate is proportional to the actual product population. The death rate curve is therefore a smaller version of the original population growth curve off-set to the right. Adding the production required to compensate for the product's death rate to the production required to meet initial population growth we get a curve that rises to a very high initial peak and then sinks back again to a low constant demand.

Demand for the product after the market has reached saturation can be improved by shortening the product's life-span (ie: the length of service it gives before wearing out) and also by making it non-repairable. The quicker it wears out, the sooner the consumer has to buy a new one. This raises the level at which the curve finally flattens out.

In a technology-driven competitive market, other enterprises will soon produce a 'better' product. This will render my original product obsolete or push it out of fashion. So the demand for the original product falls and finally sinks back to zero. So also does its price.

My enterprise therefore has to be established and expanded very quickly at first to meet this initial peak demand. I need to take on lots of labour. I need to acquire large premises. I need to buy lots of machinery and raw materials. Then, when this initial peak demand falls, I have to shed most of the labour I took on. I must get rid of most of the premises I acquired. I must sell off most of the machinery I bought. My production must fall. And so, sadly, must my income. This is not good. I must find ways of maintaining market consumption at the highest possible level so that both my enterprise, and the income with which it provides me, remain as large and as constant as possible.

Rate of Sale

Rate of growth is synonymous with the rate at which my product is being sold. And it is this that determines my daily income. So to maximise my income I must maintain as high a demand as possible. I achieve this through a variety of techniques. These include:

One way to sustain the high consumption of a product is to constantly expand its market from local to national to international to global. This progressively raises the population at which market saturation occurs.

It therefore increases total potential sales and also the final level of the constant rate of production needed to replace units as they wear out.

Narrowing my product range to include only high-priced fast movers increases my short-term profit. It also diminishes the variety I can offer my customers and degrades the quality of support I am able to provide. This severely increases my vulnerability to market change. A further way to sustain high consumption is to cut out all slow-moving product types and concentrate on a few popular fast-moving ones.

For instance, if my enterprise is a book business, I will stock and sell only fast-moving pulp fiction and not handle any specialist books for which the cost is high and the market small.

The Price of Over-Tuning

The profit-driven commercial method has served society satisfactorily in many key areas in the past simply because businesses were not as finely tuned as they are now. Low-profit slow moving items vital to the consumer were not 'tuned out' by modern analytical methods. For example, I have known the stock controller of times past who, through some antiquated sense of social responsibility, would always donate some of his storage space to discontinued items. This is because he knew that some old customer's obsolete machine may give out one day and he would need the new parts. His was a moral motive: not a commercial one. It contributed nothing to profit. Commercially it was a waste of space. But it was a great benefit to society in that it gave the greatest number of his customers a more secure and worry-free life.

With modern nit-combing profitability tuning, the managing director (now almost invariably an accountant driven only by the balance sheet of short-term monetary gain) will incisively carve out all such morally-motivated deadwood inefficiencies. "Who cares if some old artisan goes bust because he cannot obtain a discontinued component for his obsolete machine when we can increase our profitability figure on the next half-yearly account by 1·03%?" This meticulous tuning is not only done with respect to product lines, but also to market sectors. Companies cease to supply to sectors of the market (such as the poor) and put all their efforts into supplying only to the more profitable sectors of society.

The result is an attractive annual balance sheet and restricted customer service. Since most customers are individuals and most suppliers are large corporates, the customer simply has to accept what the supplier offers. How often we find a small cheap faulty component in an expensive car or household appliance simply 'unobtainable' because it is not profitable for the supplier to distribute it as a separate item? This is especially true in high technology equipment. Manufacturers will now repair equipment only by replacing the complete module that contains the faulty component. So the customer has to buy a complete new module rather than just the faulty component within it.

Forcing the consumer to buy a complete new module — and in some cases a complete new product — is far more profitable to the manufacturer. For the consumer it is very unprofitable. It is also very wasteful and damaging to the ecological environment. It uses more material, more energy and creates more pollution and waste. But naturally commercial profit must come first because commerce is in control. At least in the short term. That is, until the market changes.

The most effective way to sustain high consumption is to maintain it at its high initial level. This is done by launching a constant stream of new products. Consequently, as the market gets saturated with one product, a new one is launched. Powerful advertising is then used to induce consumers to replace the old product with the new one even before the old one has reached the end of its useful life. This creates an on-going sequence of population growth peaks as each new product is launched.

The combined demand — the total consumption — and hence production — for all these products is therefore the sum of the instant values for each of these successive peaks. This resolves into a constant high demand, consumption and production represented by the curve below, which resembles the original product population growth curve.

Notwithstanding, this curve now represents a dynamic rate of production: not a static market population. The resulting constant high demand allows a high unit price to be charged. It also creates a high rate of consumption, which translates into an equally high rate of production (units per day).

The constant high price and constant high rate of production thus achieved, compound together to yield a constant super-high rate of income for me. But the social and economic consequences of my super-high rate of income is that the market is kept in a constant state of turmoil. Products are short-lived, non-repairable, narrow in choice, inadequately made, and constantly changing in design, technology and fashion.

Life under late twentieth century capitalism has started to exhibit the characteristics of chaos. The future is becoming increasingly unpredictable. Events are starting to take everybody by surprise.

When free market capitalism was young, perhaps its progress was smooth. But it did not remain so. Under the irresistible pressure of psychological marketing projected through ever more powerful mass media, demand from the ever-expanding market soared. Under the relentless push of automation and control technology, worker productivity also soared. Thus soared the k factor of the Standard Logistic Difference Equation. The gradient of the initial rise of every product's population growth curve thus became steeper and steeper.

As a capitalist, I am never satisfied. I push technology further and further and shed more and more labour. This pushes the logistical k factor upwards and upwards. Unfortunately, as the k factor is pushed higher and higher, the product population growth curve does not merely get steeper and steeper: it changes its whole shape and character. At first, as the productivity and marketing gain from technology climbs, the curve starts to ring. It undergoes an initial oscillation, which quickly dies out as the product population settles down at its saturation level.

But technology advances further. To the lathe is added the automatic tool capstan and stock feed. To the mail is added the telegraph. To the horse and cart is added the railway. Sail is replaced by steam. To newspapers is added radio. The k factor is thus driven higher. The curve undergoes another metamorphosis. Now, instead of settling down to a steady limit it oscillates back and forth forever between two levels.

This makes even the markets for consumable staple items (which would normally not be subject to change) go through periodic boom and bust.

Even after this unstable state has been reached, technology still presses onwards. The hopper-fed capstan lathe is superseded by the numerical control machine and then the industrial robot. The railway is displaced by the heavy truck. The steamship is outpaced by the aircraft. To radio is added television. Mail is displaced by the telephone. The type-writer is replaced by the computer. Telegraphy is superseded by the Internet.

And these technological advances drive the k factor relentlessly higher until eventually the product population curve undergoes its ultimate and most catastrophic metamorphosis.

Instead of settling down to a steady oscillation after its initial climb, it now meanders up and down chaotically and unpredictably. Since the product population is chaotic, the curve representing the market's rate of demand for it is even more contorted. This means that consumption cannot be predicted. Production cannot be planned. All this is just for one product. With a constant stream of new products, including ones launched by competitors, the demand curve becomes unmanageable.

A bottomless market suddenly materialises out of nowhere creating an unlimited need for many specialist skills. The future is safe. Then just as suddenly it vanishes like the morning mist. Wasted stock. Hundreds of highly qualified specialists on the dole. A permanent workforce is no longer viable. Short-term agency-based labour is barely workable. Job security is part of history. Prices go crazy. Currencies become unstable.

I vainly try to hold prices high by dismantling surplus production capacity and destroying excess stock to make it scarcer. I force others to follow by influencing government to raise interest rates. But the result is mass unemployment. So instead of the labourer feeding me with profit, I must now feed the labourer through the social security system. Otherwise I must face the violent consequences of social revolution. Far from stabilising the market, these frantic attempts by us capitalists, and the government we support, merely pave the way for even more extensive and more destructive crises. Furthermore, they actually reduce the ability of the economy to withstand such crises.

This is because this chaotic instability within the market has nothing to do with human management of the economy. It is not even to do with the nature of the economy itself. It is in fact a fundamental property of the Standard Logistic Difference Equation. It is caused by something as basic as the nature of numbers themselves. So as long as the capitalist deploys ever more productive technology in his unrestrained quest for greater and greater profit, the k factor continually rises. Demand from the market becomes increasingly more chaotic. The cycle of boom and bust itself becomes ever more frequent and extreme. Fortunes are won and lost in an instant. Life becomes ever more stressful and uncertain. Social disintegration becomes inevitable.

Parent Document |

©September 1995, January 2013 Robert John Morton